| Link(s): | The FCA and PRA propose measures to boost diversity and inclusion in financial services | FCA CP23/20: Diversity and inclusion in the financial sector – working together to drive change | FCA |

Context

The FCA has published a consultation paper, the aim of which is to enhance the safety and soundness of firms and improve understanding of diverse consumer needs. The FCA believes that increased diversity and inclusion in regulated financial services firms can deliver better internal governance, decision making and risk management.

Key points to note

The proposed rules aim to see increased diversity and inclusion in firms translate into better internal governance, decision making and risk management. That contributes to promoting the safety and soundness of firms, policy holder protection and better outcomes for markets and consumers. The proposals also set flexible, proportionate minimum standards to raise the bar, placing more requirements on larger firms.

Proposals set out for firms include requirements to:

- Report their average number of employees to us on an annual basis

- Develop a diversity and inclusion strategy setting out how the firm will meet their objectives and goals.

- Collect, report and disclose data against certain characteristics.

- Determine and set appropriate diversity targets

- Set targets to address under-representation.

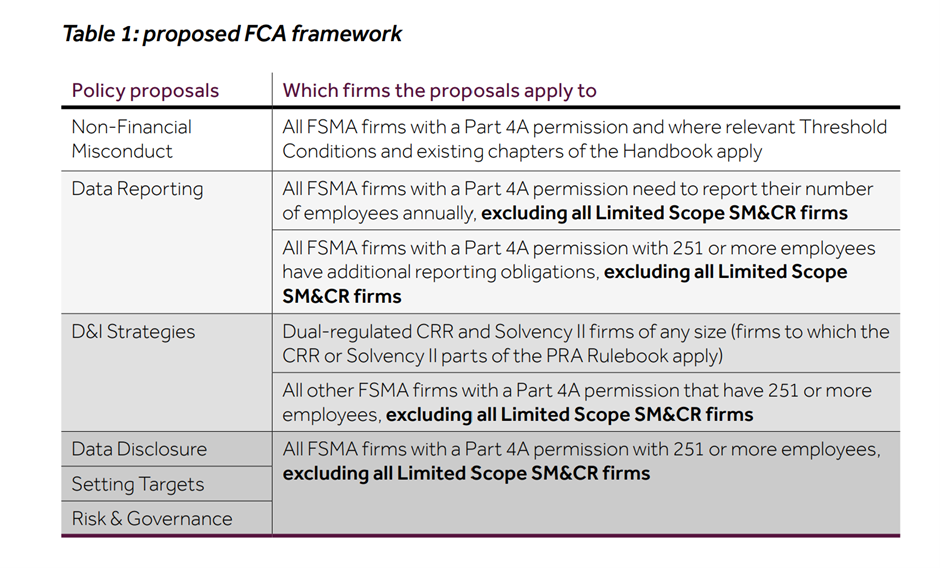

The FCA recognises the need to be proportionate in this area and firms with less than 251 employees would be exempt from many of the requirements, especially parts of the new proposed regulatory return. The table below, an extract from the Consultation Paper, sets out the various reporting requirements, and the types of firms captured.

The consultation is open until 18 December 2023. The FCA welcome comments on the proposed approach taken and the feedback will be used to develop final rules planned for publication in 2024.

Next actions

None – for information and awareness.