Context

In November 2020 the FCA published a Consultation Paper CP 20/22 outlining proposed policy changes to the way it will apply fees from 2021/22. This was followed by a further Consultation Paper in April 2021 which included feedback on the proposals outlined in the November 2020 consultation. The FCA has now published a Policy Statement which sets out the new structure for authorisation application fees. Most application fees have not changed since the Financial Services Authority (FSA) introduced them nearly 20 years ago. When reviewed in 2020 there were more than 80 separate charges for FCA applications identified.

Key points to note

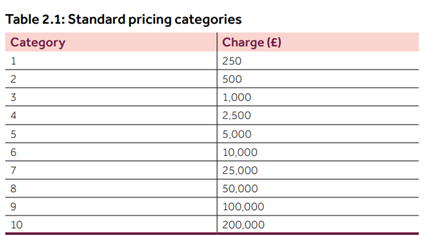

- The FCA has condensed the charges into 10 pricing categories as listed in the table 2.1. Variations of Permissions (for Permissions within the same fee bock) will fall into Category 2 – £500, while Authorisation fees fall within Categories 4 – 8. The applicable category and fee payable will be dependent upon which fee block a firm falls into.

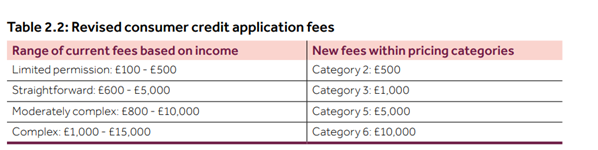

- Consumer credit application fees are split out as in the table 2.2.

- The FCA has confirmed it will be introducing a new charge of £250 for stand-alone Long Form A applications under Senior Managers regime and CF(AR) functions. This charge will be triggered by the submission of the long form A and will be payable per form, regardless of the number of entities covered by the application. To avoid unnecessary payments firms should take care not to make applications on the long form when they can use the short one.

- The fee will be paid online when the Long Form A is submitted. The FCA will be undertaking further work before the introduction of this new charge and will give notice of the implementation date through a handbook notice.

Next actions

The new structure for authorisation application fees comes into effect from 24th January 2022. The FCA will give notice of the implementation date of the £250 charge for submission of a Long Form A in due course.