Context

The REP021 return on RegData is due by 30/09/2022 for the Reporting Period 01/01/2022 to 30/06/2022. The full REP021 report can be found here.

Key points to note

For insurance brokers, the REP021 return on RegData is split into three separate RegData reports:

- REP021c – this is Section 4 of the REP021 template as per the document in SUP 16 Annex 49A, and relates to intermediaries which are price-setting on home and private motor insurances.

- REP021d is ALWAYS a ‘nil’ return as there is no option on RegData other than to answer ‘Yes’ in the normal menu. This is the equivalent of Section 5 of REP021 (price-setting on closed books). If an intermediary DOES have data to report, this has to be done as an XML file.

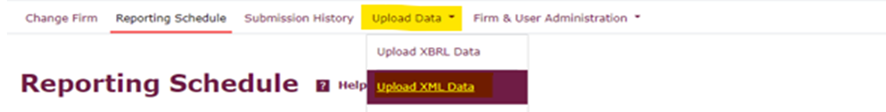

If a firm selects ‘No’ as the response for the nil return question, and attempts to validate the submission, a validation error appears asking for an XML submission. To create an XML submission, it is necessary to use a different area of RegData. Rather than using the Reporting Schedule, it is necessary to instead select the Upload Data option, and click on Upload Xml Data from the drop-down.

This then opens up another version of your usual submissions page, and the reports making up the usual Reporting Schedule will re-appear. Instead of square boxes to the left of each one, there is a radio button. Scroll down to REP021d and click the radio button to its left.

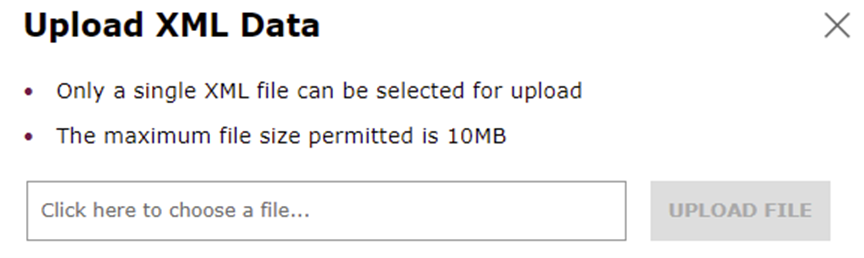

If you then click on ‘UPLOAD DATA’, this box appears; you then have to select the XML file you have created (on your PC or wherever it is stored) with the data in it, and upload it.

To create an XML file of the data to submit, collate the data in an Excel spreadsheet and save it as an XML file.

- REP021e is the equivalent of Section 6 of REP021, which is retail premium finance, add-ons and fees/charges in relation to private motor and home insurance. This is the main section that most intermediaries transacting these types of insurance will need to complete in full (unless these firms take standard rates of premium finance, don’t sell any add-ons (e.g., legal expenses) and don’t charge any fees or make additional charges on top of the insurer’s premium).

Next actions

None – for information and awareness.