Context

The FCA has issued its next Quarterly Consultation Paper, No. 33, as CP21/27. There are a number of items included within the Consultation with differing consultation periods, two of which are more relevant to firms that we support:

Chapter 2 – an amendment to how legal expenses insurance is reported under the value measures reporting – consultation period 3 weeks

Chapter 3 – to move application forms from the Handbook – consultation period one month

Key points to note

Value Measures Reporting

- Following the publication of the GI value measures reporting and publication Policy Statement (PS20/9), the FCA has received feedback from firms about the product reporting categories for legal expenses insurance.

- Firms recommended that the data for legal expenses insurance be split between ‘Before the Event’ (BTE) legal expenses insurance and ‘After the Event’ (ATE) legal expenses insurance, noting that these types of insurance are significantly different in nature.

- For Value Measures reporting purposes the FCA has said that, while both ATE and BTE products cover legal expenses, it understands that they have significantly different claims profiles and claims acceptance rates. Given these differences, there are advantages to collecting value measures data on each product separately.

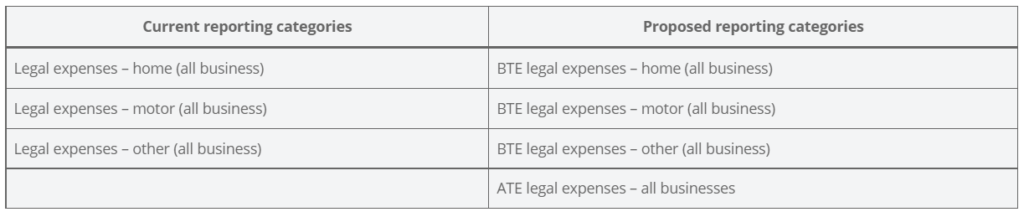

- The FCA is therefore proposing to change the reporting categories for legal expenses insurance to split out ATE and BTE as follows:

- The FCA proposes that for the first value measures reporting period (1st July 2021 to 31st December 2021) there should be a transitional arrangement so that firms can report legal expenses data on either the existing reporting categories or the proposed new reporting categories.

- For reporting periods from 1st January 2022 onwards, the proposal is that firms must report on the new reporting categories.

Other minor reporting amendments

- The list of products covered by the value measures reporting requirements (SUP 16 Annex 48R) includes two products which were omitted from the reporting form itself. These were key cover and motor pothole insurance. The FCA is amending the reporting form to make clear that firms must report data on these products.

Moving application forms from the Handbook

- Usually, the FCA consults on changes to all Authorisation forms within its Handbook; however, it is not legally obliged to consult in respect of forms that have been made through Direction (so under the FCA’s power to make under a Direction, which may be set out in guidance) as well as those prescribed in legislation and / or set out in specific rules.

- Where the FCA has consulted on changes to Authorisation forms in the past it has received minimal feedback.

- This consultation proposes:

- to not consult on any future amendments to the forms that are currently in the Handbook and made through Direction

- to remove Authorisation forms that are made through Direction from the Handbook – these will link to the latest version of the form on the FCA website

- to seek views on whether, longer term and in line with statutory requirements, the FCA should not consult on any form amendments and should remove all our Authorisation forms from the Handbook

- These proposed changes will be of interest to applicants seeking:

- to apply to cancel

- to apply for a variation of permission

- to apply for a waiver

- to apply for approved persons

- The list of forms affected by this proposal can be found in the first list of forms in the ‘Summary of proposals’ in Chapter 3 of the Consultation.

Next actions

None – for information and awareness but firms should review the list of affected form as set out in the consultation.